When we talk about most demanding career opportunities these days, we can find banking in top five. Unquestionably, banks are the backbone of any country’s economy and hence choosing your career in banking sector will bring enormous job opportunities for you.

You can analyze constant vacancy notifications coming from various banks located across the country and in such scenario as a banker you can look up for a relaxing lifestyle. Here I have shared some useful information associated with career in banking including your job responsibility, pay scale, career growth etc.

Introduction

Banking today is undoubtedly a lucrative career for enthusiasts in the domain of accounts and commerce. For the beginners, it would be the foremost step towards recognizing the global economy, analyzing the challenges of the market and exploring vast job opportunities across the country as well as abroad.

Check- Bank calendar

Job Responsibility

As a Bank Probationary Officer (PO) your responsibilities will be-

- Dealing with various banking activities. You must familiarize with various working sections of the bank;

- You need to be comfortable with accounting, marketing, finance as well as loans & advances;

- You need to handle customers with their issues. If any customer finds any sort of discrepancies with any of the bank products he/she will ask you to deal with;

- You need to supervise clerical work;

- You’ll be responsible for loan processing;

As a Bank Clerk, your responsibilities will be–

- You’ll have to deal customers at withdrawal and deposit counters;

- You’ll be responsible for sanctioning withdrawals, accepting payments, issuing demand drafts, verifying cheques and other associated services;

- You may be involved with marketing of bank’s financial products;

As a Bank Specialist Officer (SO), your responsibilities will be-

Major Specialist officer positions in banks are IT Officer, HR/Personnel Officer, Law Officer, Agricultural Field Officer, and Marketing Officer. Your role will vary depending upon your position. We have highlighted few jobs responsibilities of Specialist Officer, please have a look:

- Providing support for bank’s core banking system;

- Managing sub-systems of banks such as Kiosks, ATM, Networking, Internet and Mobile banking etc;

- Handling marketing and promotional activities;

- Developing powerful marketing strategy for boosting sales and marketing;

- Dealing with documentation works;

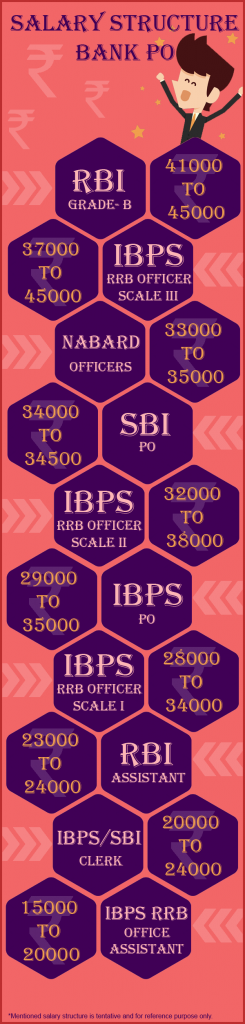

Pay Scale

We are specifying below expected salary of various bank positions. Below mentioned data is not exact, however you may take it as reference:

How to Crack Bank Exam?

How to Crack Bank Exam?

We are sharing below few sure success strategies which will help you to crack bank exams:

Ques 1: Tell me about most effective tips to clear bank exam.

Ans: Please have a look:

- Speed up your problem solving skill. See, you’ll get less times and cutoff is usually high, so you need to solve maximum problems within limited times period of time. For the same, you can practice various mock tests and model papers.

- Solve easy questions first then go for complex ones. Give less time to easy questions and save your time to solve complex problems.

- Finish those sections first which you think will take less time.

- Don’t get frustrated during exam. Be calm and think about questions, not result.

Ques 2: How much time should I give for an effective bank exam preparation?

Ans: It varies according to the students’ ability. However, 6-12 weeks is considered ideal for fairly good candidates, 13-15 weeks for beginners and 5-6 weeks for MBA aspirants.

Ques 3: What are the major factors to crack bank PO exam?

Ans: If you are a bank PO aspirant then you must be truly comfortable with followings:

- Fast calculations;

- Good in English Grammar and Math;

- Current events held across the country;

Ques: What tricks to be followed to score good in the exam?

Ans: It depends upon person to person. As I prefer to solve papers in the sequence as English, General Awareness, Math and at the end reasoning section. However, I suggest you touch the section first in which you are more comfortable.

Common Interview Questions and Tips to Answer

- Why have you chosen your career as a banker?

- Which type of lifestyle you’re expecting as banking professional?

- Where do you want to see yourself after five years?

- Why should we hire you for our organizations?

- Tell me about your hobbies.

- Tell me the meaning of your name.

We have shared above few most common interview questions which are usually asked in the bank’s interview. While answering these questions you need to take care of followings:

- Be confident while answering questions;

- Don’t get feared, C’mon they are also human being? Answer questions with positive attitude.

- During interview don’t think about your selection, just give your best.

- Maintain your positive and relaxing gesture and posture;

- Don’t be overconfident. You need to answer questions with relaxed posture.

my date of birth is 01/06/1983 belongs to scheduled caste,am i applicable to write ibps bank exam in the year of 2017

No.One more thing if you can read and write, then don’t stick anymore to schedule caste tag. Be competitive and follow the same approach there are people from open caste who can’t even afford to have basic education.

How to prepare for English.. it most difficult to Attend.. Pls give me some ideas

Hello Bhai my age is below 20 can I gave any exam.

My date of birth is 17 06 1996 can I apply

you can not because you age is not 21 as on 1april2017. You can apply for next year.

My birth date is 11 November 1997. Could I give SBI PO exam next year?